nj property tax relief fund 2020

We Offer A Free IRS Transcript Report Analysis 499 Value. Book A Consultation Today.

Tax And Water Collection Township Of Franklin Nj

Average bill more than 9000 Homeowners should also be provided a way to pay their property taxes on a monthly basis to.

. Check Your Eligibility Today. Property Tax Relief Programs Homestead Benefit. We will begin mailing 2021.

We Offer A Free IRS Transcript Report Analysis 499 Value. The Homestead Benefit program provides property tax relief to eligible homeowners. NJ property taxes climbed again in 2020.

New Jersey Gov. Im proud to say that three of the five lowest property tax increase ever. What is the property tax Relief Fund in NJ.

Consult With ECG Tax Pros. Stay up to date on vaccine information. Check Your Eligibility Today.

The up to 35000 payment would come in the form of a three-year. Rated Number One For Businesses. Senior Freeze Property Tax Reimbursement Program.

For information call 800-882-6597 or to visit the NJ Division of Taxation. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

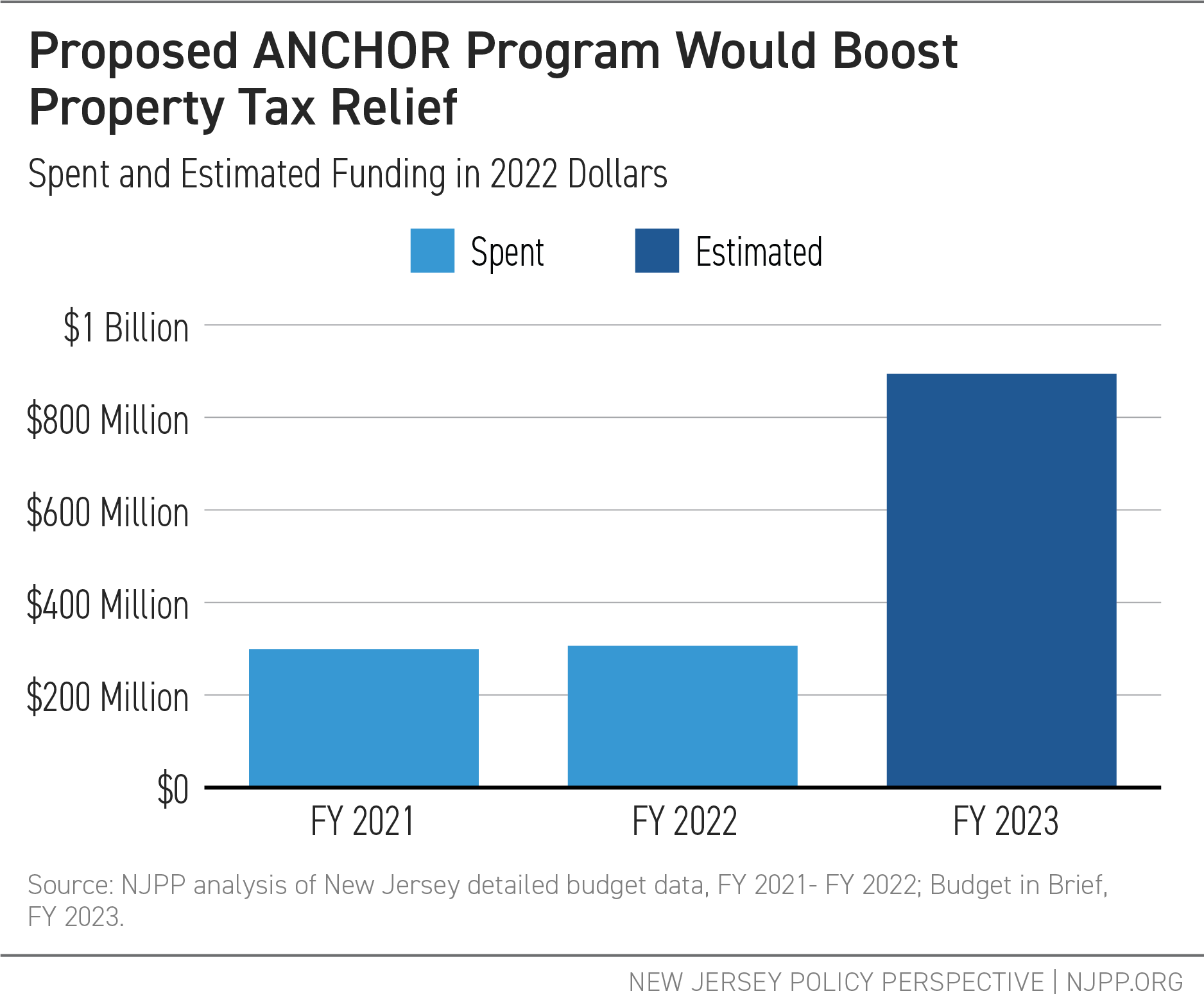

Phil Murphy wants to increase how much the state spends each year on property-tax relief benefits so more New Jersey residents can receive them. COVID-19 is still active. Homeowners making up to 250000 per year may.

The rebates will be hitting the mail as soon as July 1 sending 500 to over 750000 New Jersey families. 2021 Senior Freeze Applications. The main reasons behind the steep rates are high property values and education costs.

Proceeds from spousescivil union partners life insurance. NJ Division of Taxation - Local Property Tax Relief Programs. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023.

Forms are sent out by the State in late Februaryearly March. For most homeowners the benefit is distributed to your. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

Book A Consultation Today. The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

You are eligible for a property tax deduction or a property tax credit only if. Mortgage Relief Program is Giving 3708 Back to Homeowners. To qualify your mortgage or other housing costs must not have been delinquent before January 21 2020.

All property tax relief program information provided here is based on current law and is subject to change. Ad Suffering From Tax Problems. Ad Suffering From Tax Problems.

Mortgage Relief Program is Giving 3708 Back to Homeowners. For more than 15 million homeowners earning up to 250000 average savings would be 700 and would come in the form of rebates on their tax bill. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

Consult With ECG Tax Pros. Rated Number One For Businesses.

State Local Property Tax Collections Per Capita Tax Foundation

The Official Website Of City Of Union City Nj Tax Department

Deducting Property Taxes H R Block

The Official Website Of City Of Union City Nj Tax Department

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Murphy S Property Tax Rebate Proposal Adds Renters Video Nj Spotlight News

Nj Property Tax Relief Program Updates Access Wealth

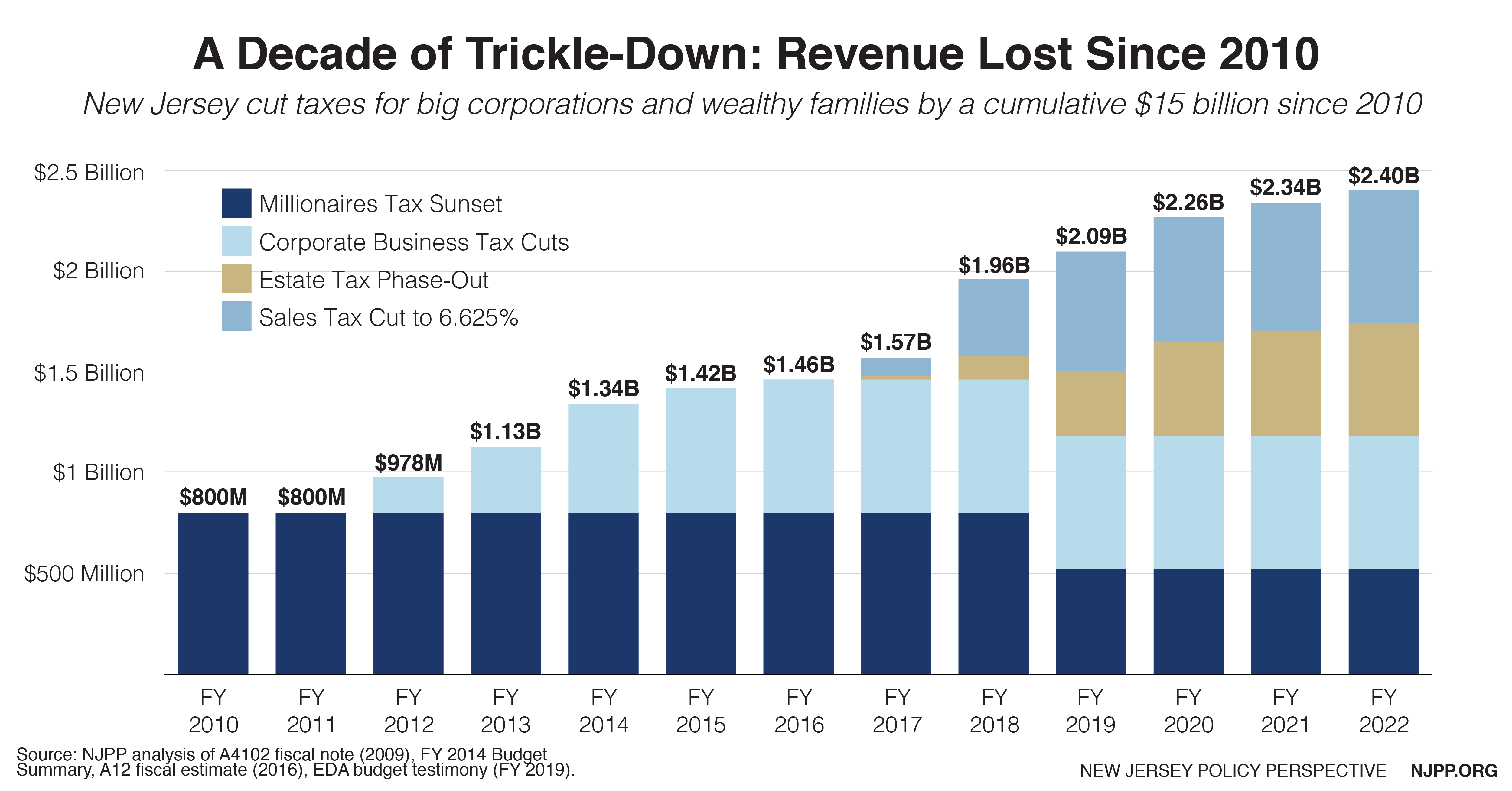

Breaking Down Governor Murphy S Fy 2023 Budget Proposal New Jersey Policy Perspective

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News

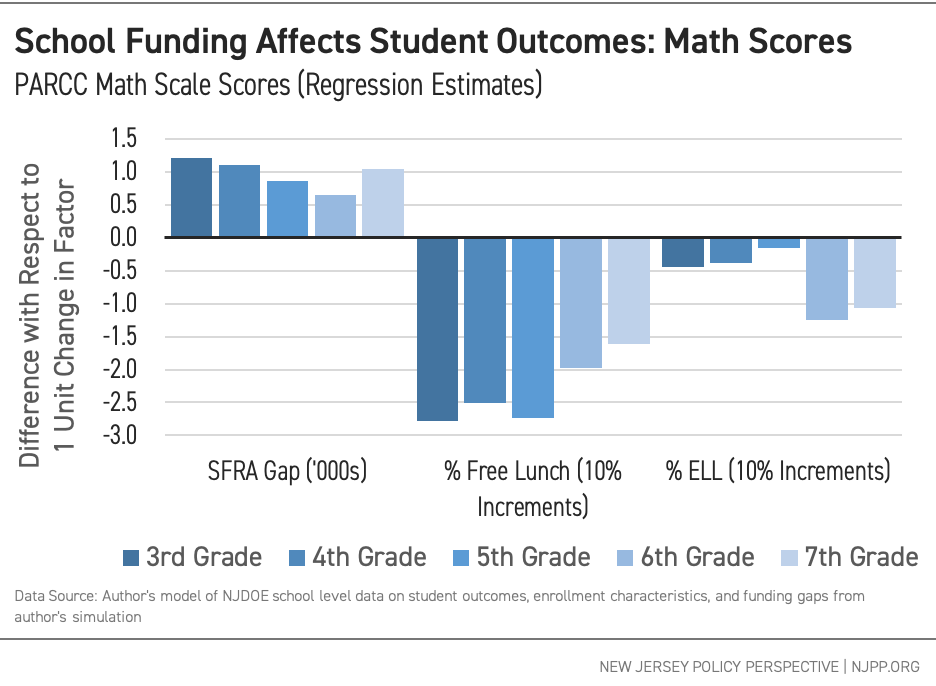

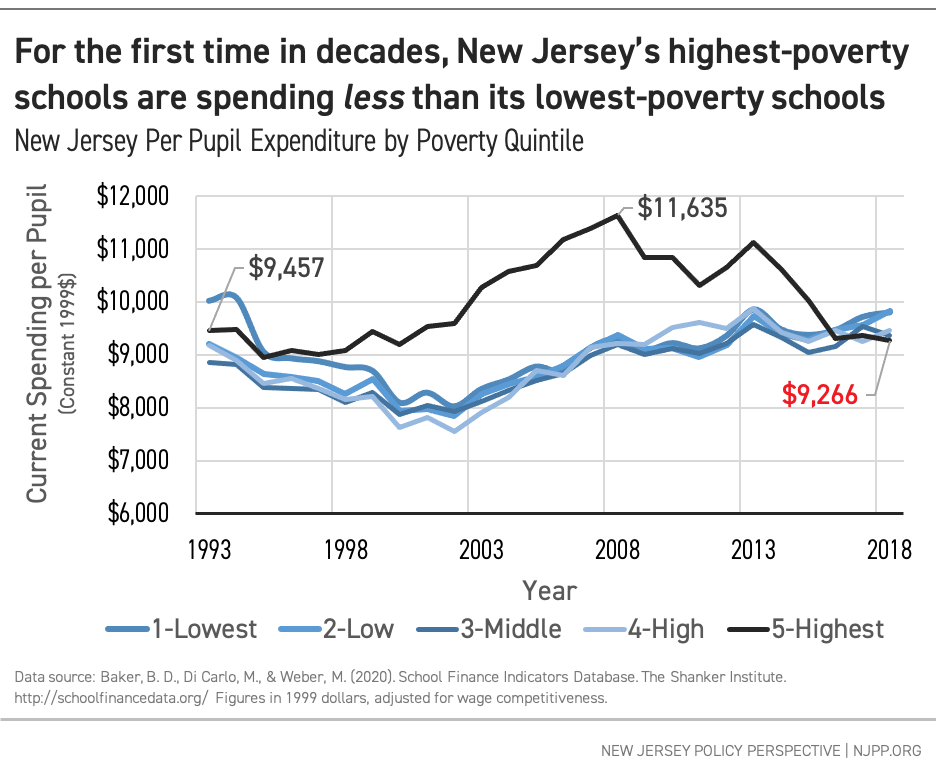

School Funding In New Jersey A Fair Future For All New Jersey Policy Perspective

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

School Funding In New Jersey A Fair Future For All New Jersey Policy Perspective

Tax Assessor Township Of Franklin Nj

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

Florida Property Tax H R Block

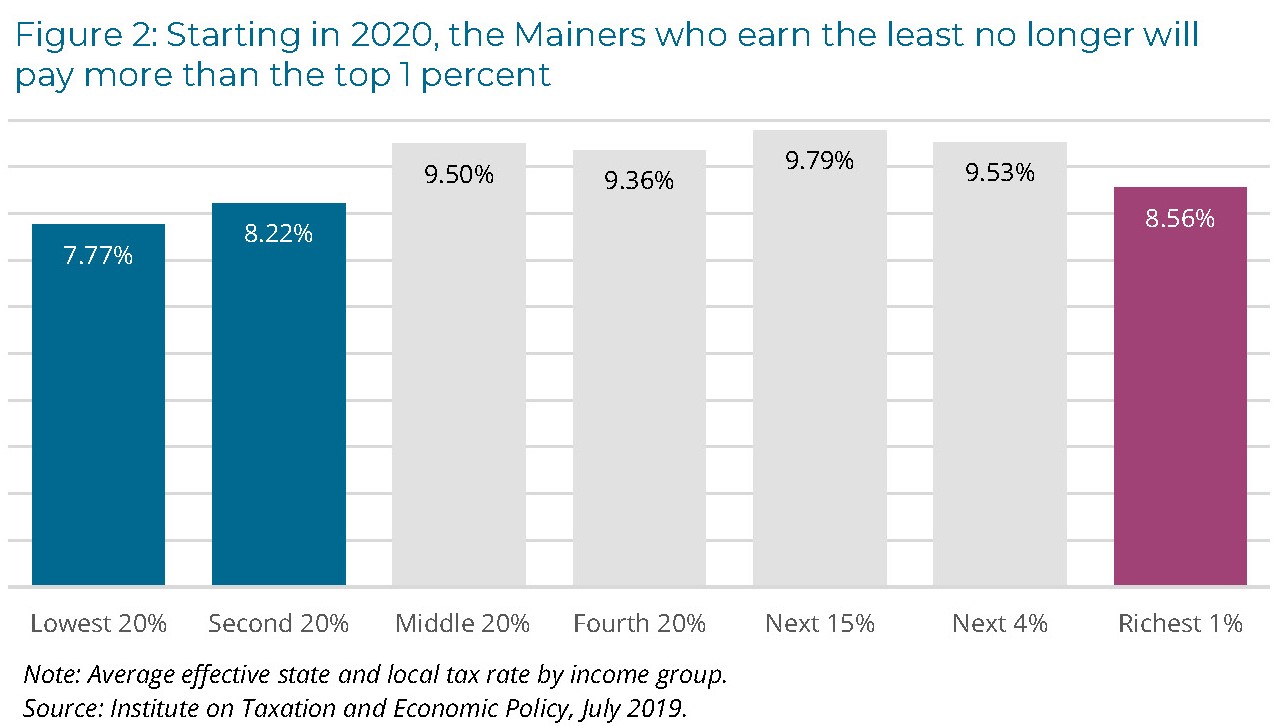

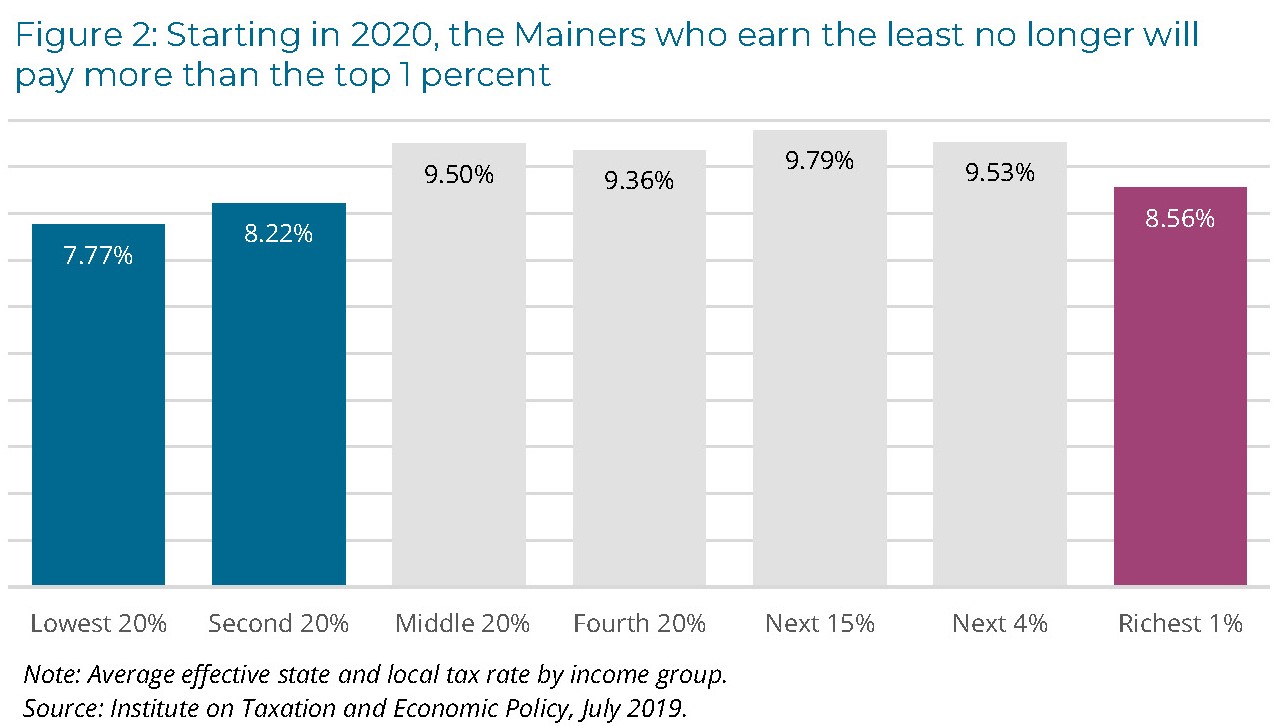

Maine Reaches Tax Fairness Milestone Itep

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times